19 Things That’ll Only Make Sense If You’re So Broke, You're Eating Cereal With A Fork To Save Milk

The days leading up to payday can be the most trying. With no money in the bank and bills looming overhead, you find yourself stretching pennies, questioning if you really need that extra packet of chips or if you can get away with just one more roll of toilet paper.

It's a tough situation to be in, and the thought of not having enough money can be overwhelming. The anticipation of payday, however, can be enough to keep you going.

Knowing that soon you will have the money to pay your bills and have a little left over for some fun can be a major motivator. But when payday comes, it's almost like you realize it was all for not.

You've been pinching pennies for days, and your bank account still doesn't look any different. It's a discouraging feeling, and it can be hard to keep motivated. That's why it's important to remember the value of those days in between paydays.

Even if you don't have money to spend, there are still ways to enjoy yourself and make the most of your time. Taking a walk, enjoying nature, or reading a good book can be just as rewarding as buying something new.

Plus, it's a great way to stay productive and get a break from the stress of money. Paydays may come and go, but those days in between can make all the difference.

Instead of focusing on the lack of money and the wait for payday, take the time to appreciate the small moments and enjoy the simple pleasures life has to offer. It may not be the same as a luxurious shopping spree, but it'll make the wait for that next paycheck a little bit easier.

1. I regret my purchases from the past.

Tumblr

Tumblr2. Eat every single bit of food in your kitchen.

Twitter

Twitter3. Finding alternative ways to stay active without paying for a gym membership.

4. Evaluating all of your choices even when times are tough.

Twitter

Twitter5. Being in a negative state of mind all the time.

Twitter

Twitter6. Handling a difficult situation with creativity.

Tumblr

Tumblr7. Getting charged a fee for not having any funds.

Twitter

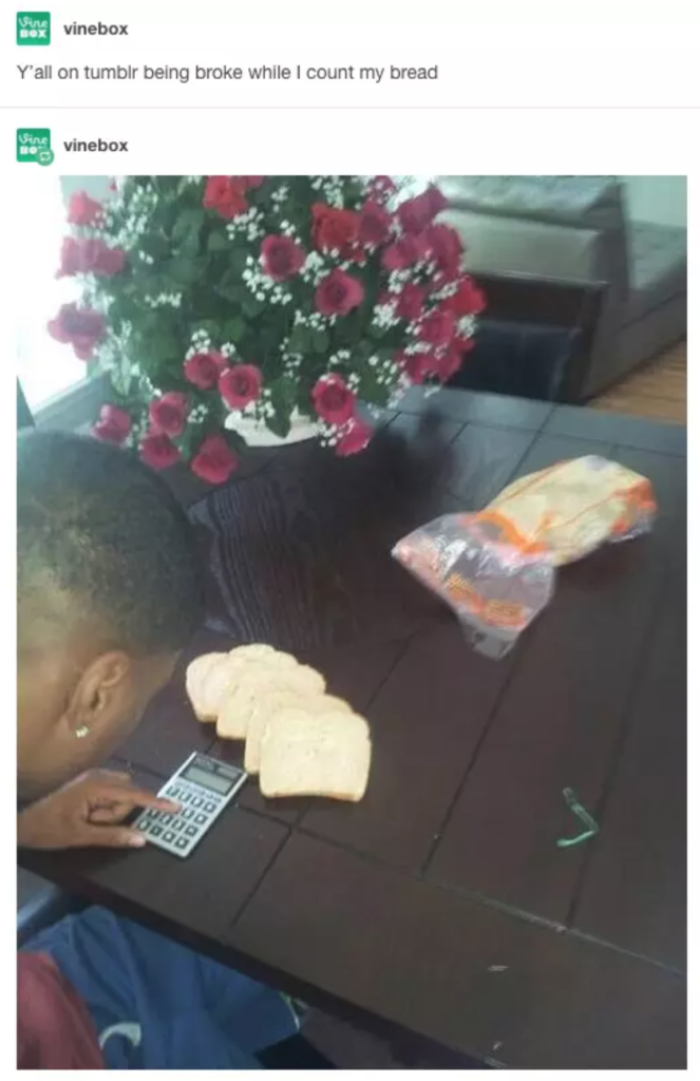

Twitter8. Tallying the loaves.

Twitter

Twitter

9. Instead of blaming yourself for your situation, blame the system.

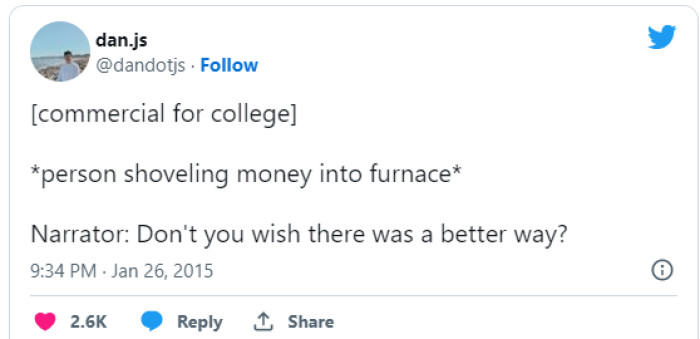

10. I questioned myself why I decided to go to college.

Twitter

Twitter

11. Exploiting the generosity of family and friends.

Twitter

Twitter

12. Admiring coupon shoppers as the economical goddesses they are.

Tumblr

Tumblr

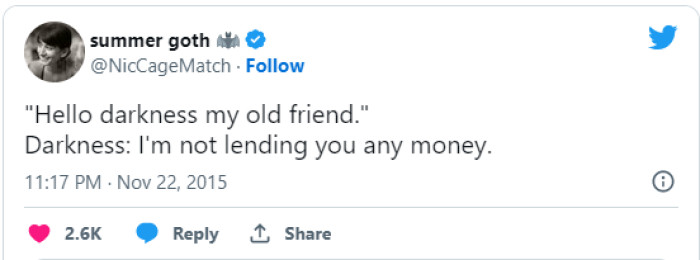

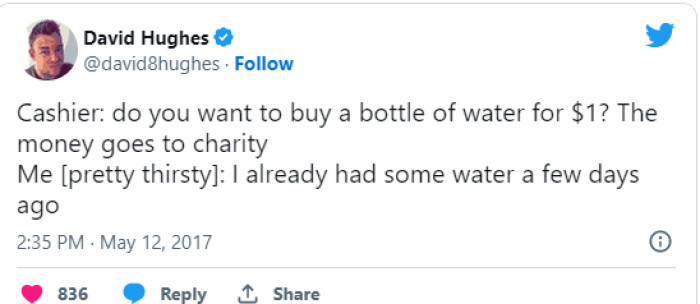

13. Refusing to meet basic needs.

Twitter

Twitter

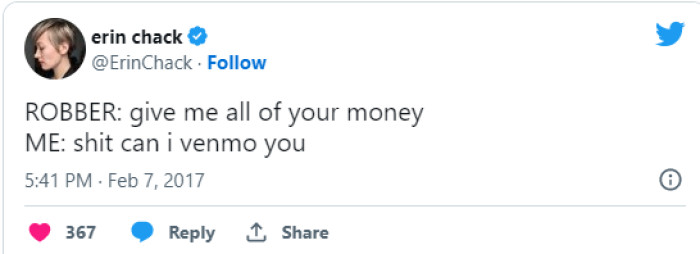

14. Requesting an ‘IOU’ instead of an immediate payment.

Twitter

Twitter

15. Engaging in shopping as a form of self-soothing which leads to further emotional issues.

Twitter

Twitter

16. Looking for ways to have fun without spending a lot of money.

Twitter

Twitter

17. Throwing away your ethics for a flow of money.

Twitter

Twitter

18. Contemplating what could be accomplished with increased financial resources.

Twitter

Twitter

When it comes to those days leading up to payday, it's important to remember that it's not all doom and gloom. Instead of focusing on the lack of money and the wait for payday, take the time to appreciate the small moments and enjoy the simple pleasures life has to offer.

Sure, a shopping spree might sound nice, but it's not the only way to enjoy life. So take a walk, enjoy nature, or read a good book.

After all, paydays come and go, but those days in between can make all the difference!